What is asset protection?

In the financial world, asset protection means using strategies to guard your wealth from seizure or other forms of loss.

In a very practical sense,asset protection includes these basic steps:

![]() Cataloguing your assets in a secure environment

Cataloguing your assets in a secure environment

![]() Tracking your assets

Tracking your assets

![]() Applying technical, financial, legal or other means to protect your assets in a case of an unforeseen event

Applying technical, financial, legal or other means to protect your assets in a case of an unforeseen event

Financial service companies can offer features such as estate planning, offshore trusts, and irrevocable trusts, but these often represent the basic minimum that asset owners need to fulfil the goal of asset protection.

Who is it for? And in which Life Situations?

Asset protection was rarely needed 100 years ago when people rarely had more than a bank account, life insurance, and real estate properties. And these were the very privileged few – even these assets, so common nowadays, were unthinkable for the majority of the population 100 and more years ago.

Today, things are quite different. Many people have diverse and complex assets, often in multiple countries. Tech companies give stock options or RSUs to their employees, expats have assets in multiple countries, and more and more people invest in stocks and buy cryptocurrencies.

Asset protection is usually needed when you fulfil most of the criteria below:

You have multiple types of assets – life insurance, bank accounts, stock options, company stocks, cryptocurrencies, real estate, to list a few. This increases the complexity of asset tracking for the owner, and especially for the beneficiaries.

Your assets reside in more than one country. This situation is particularly familiar to expats. When they move from country to country, they usually leave a bank account here, life insurance or a pension fund there. This further complicates the asset tracking and, as a result, increases the need for asset protection.

Your family members live in a country different from the country where your assets are stored. For example, you live in the US and your assets are there, but your family members are in South America, Europe or Asia. This makes asset identification and location especially challenging for the family members.

Most common risks for your assets

We are not talking about risks related to asset management, e.g., investing in stocks, but risks related to losing assets even when they are in a passive state, for example, real estate, bank accounts, insurance policies, etc.

Typical risks related to your assets:

- financial crisis (assets lose value sharply)

- theft (assets are stolen via fraudulent transfer or other means)

- forgetting about an asset (e.g., an old bank account or insurance policy)

- heirs not being able to identify and locate assets in the event of the death of the owner.

The risks fall into two groups. The first is related to external events or actions (fraud or financial crisis), and the second is the result of personal events or actions – death, forgetting about an asset, etc.

Types of asset protection

These are the most common asset protection tools:

- Asset protection trusts

- Insurance policies

- Family limited partnerships (FLP)

Using these tools requires a lot of time and effort. But apart from that, you will notice that the most common asset protection tools target primarily external risks. They fall short when it comes to personal risks.

Most common protection techiques

![]() storing a list of assets on the hard drive of your computer

storing a list of assets on the hard drive of your computer

![]() printing the list on paper and storing it in a secure place

printing the list on paper and storing it in a secure place

![]() using a digital vault

using a digital vault

![]() storing the information on Excel or Google Sheets.

storing the information on Excel or Google Sheets.

You can’t fail to notice that while the protection tools relating to external risks are quite sophisticated, the tools used to protect your assets from personal risks are all over the place. And, most importantly, they fail to cover against some very important internal risks:

- These options fall short if anything were to happen to you AND your partner together.

- The people with whom you share the information about your assets might forget how to access it. Or they might be too young or too old to remember the access instructions.

- And most importantly, they don’t give you the option to allow access ONLY if something happens to you, not before.

How big is the problem of protecting your assets from these risks? It’s huge. So-called unclaimed assets approach $100B in the US alone. Latest reports for the UK show £77B. Globally, we are talking about trillions of dollars. And the upward trend is alarming – a $5B increase per year just in the USA.

How does DGLegacy’s asset protection work?

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets

![]() Can identify and locate your assets

Can identify and locate your assets

![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

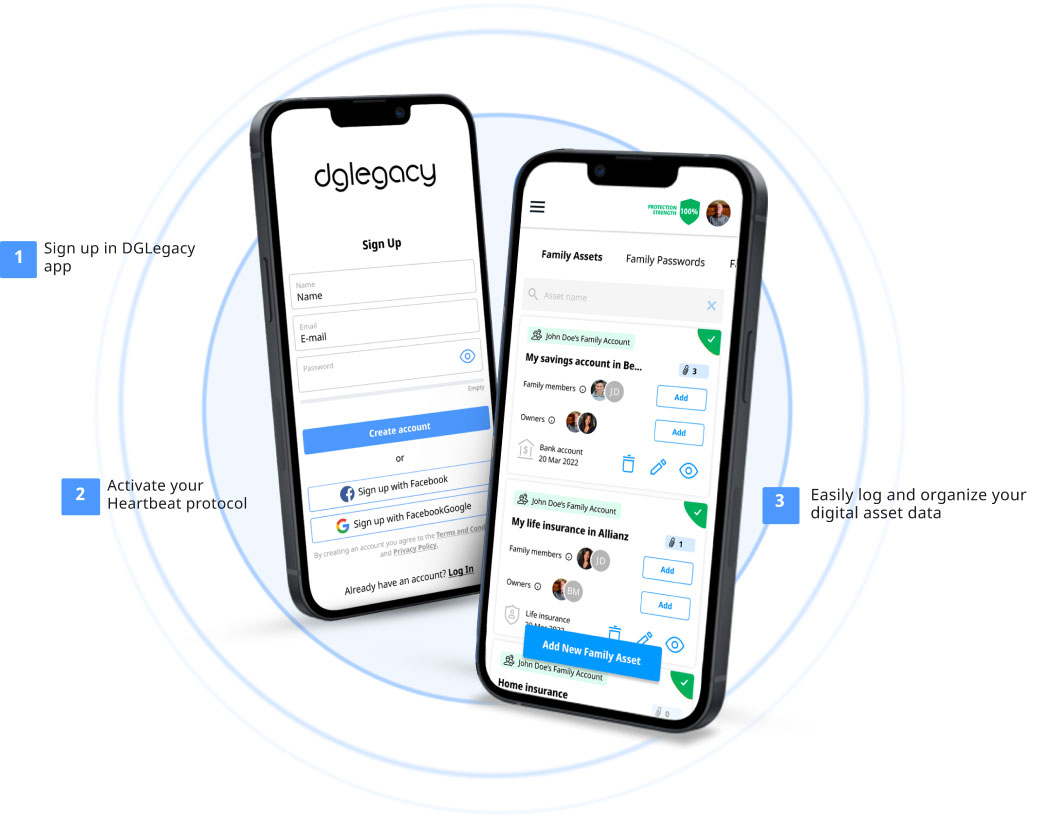

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the people who trust DGLegacy® and start protecting your assets now.

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz