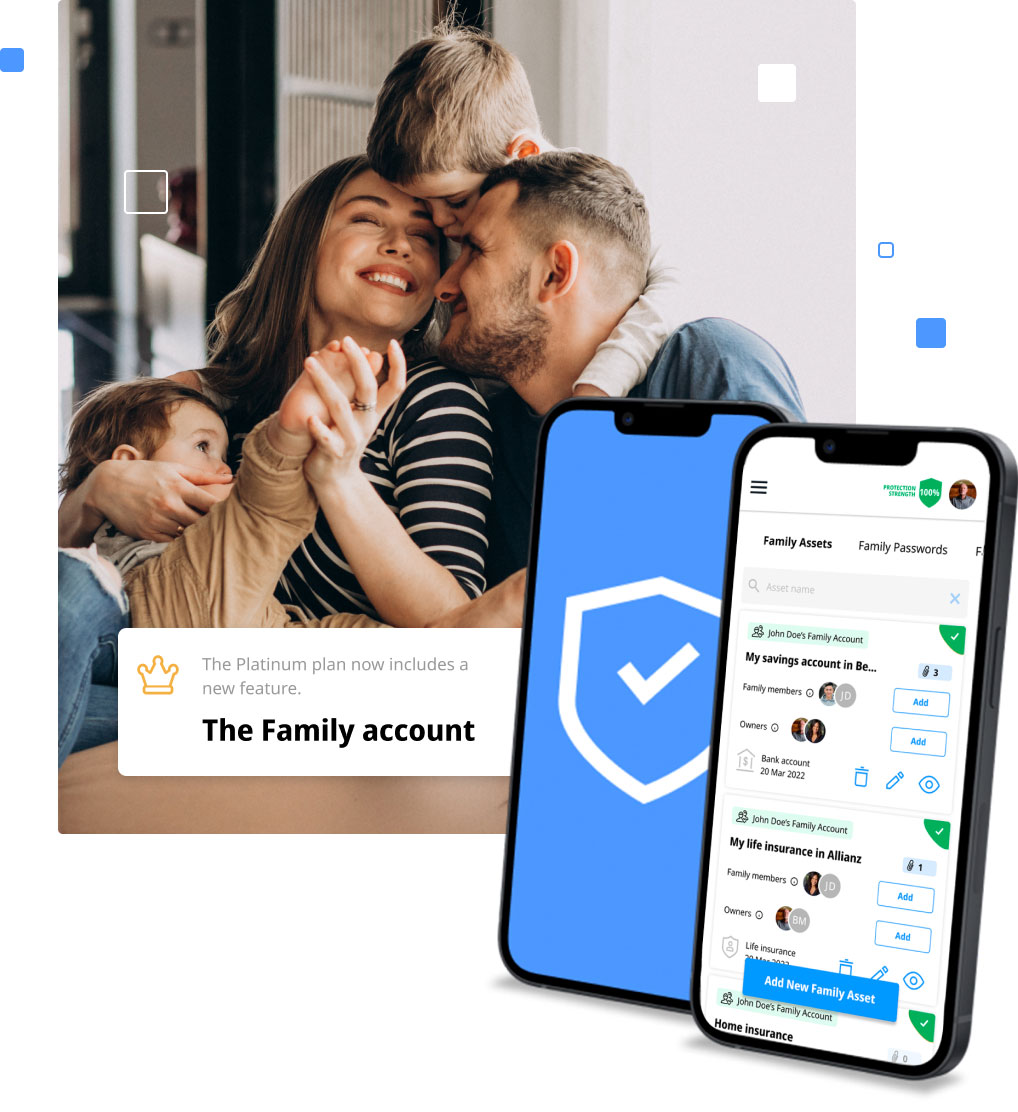

Family account

Protect your family assets and accounts

Share, organize, and collaborate with your family members on managing your important family assets and account credentials.

Platinum plan

BE SURE that your loved ones and assets are protected.

NEW feature

How to use your Family Account?

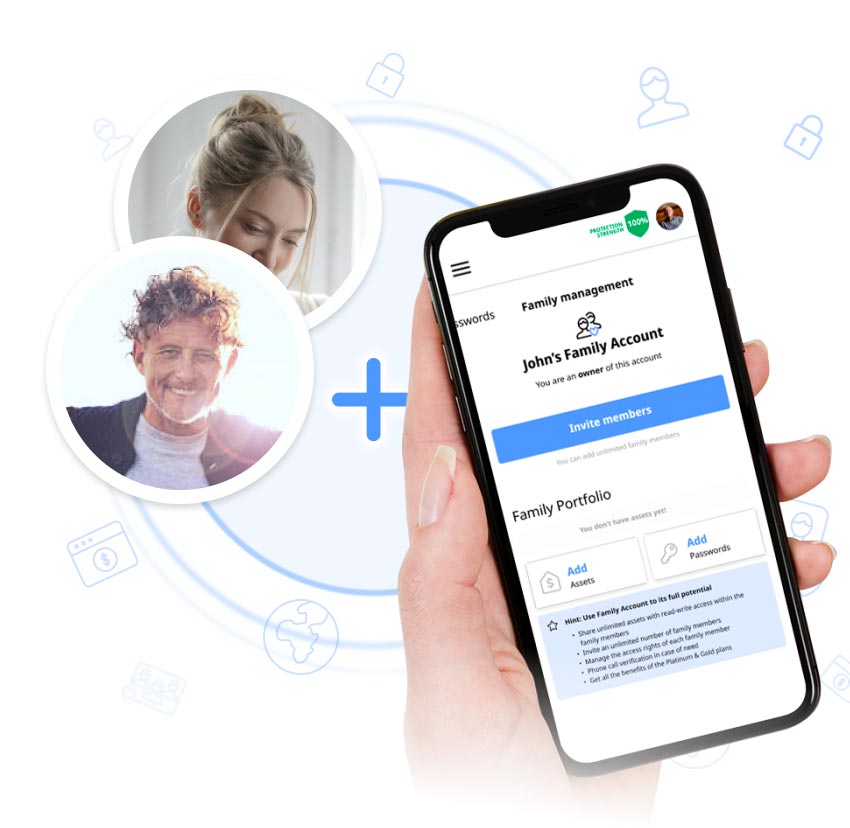

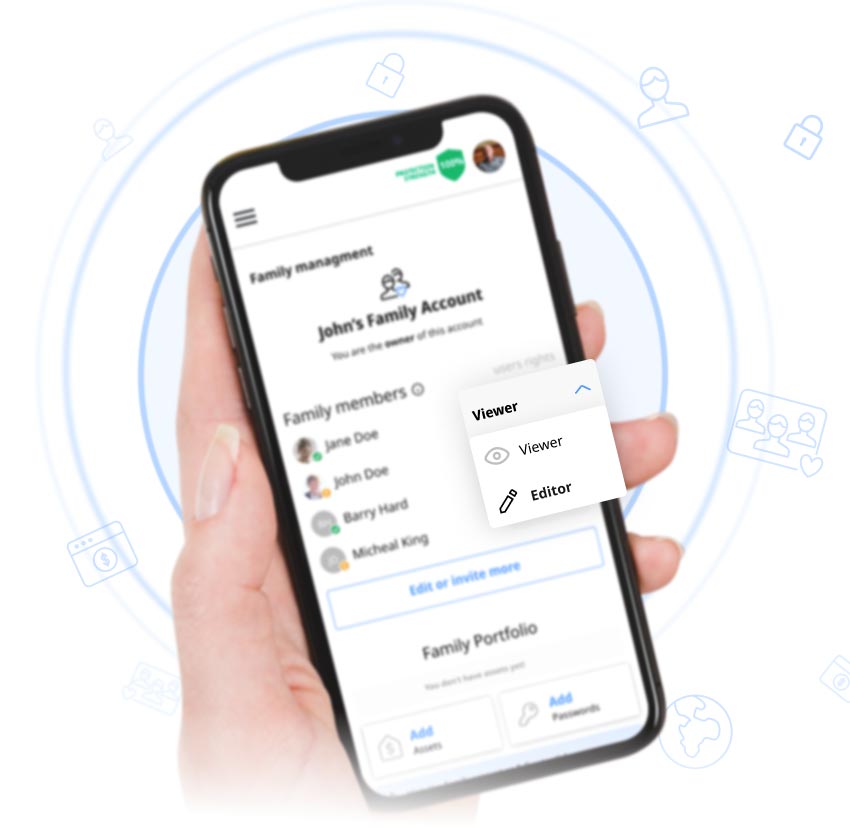

Add family members

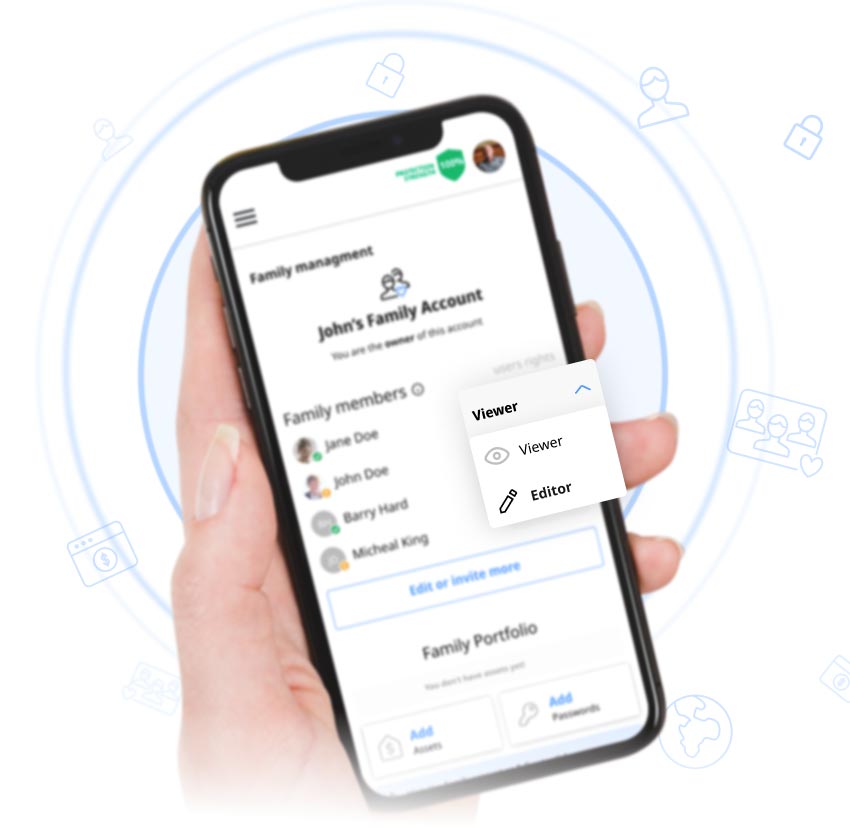

Set permissions

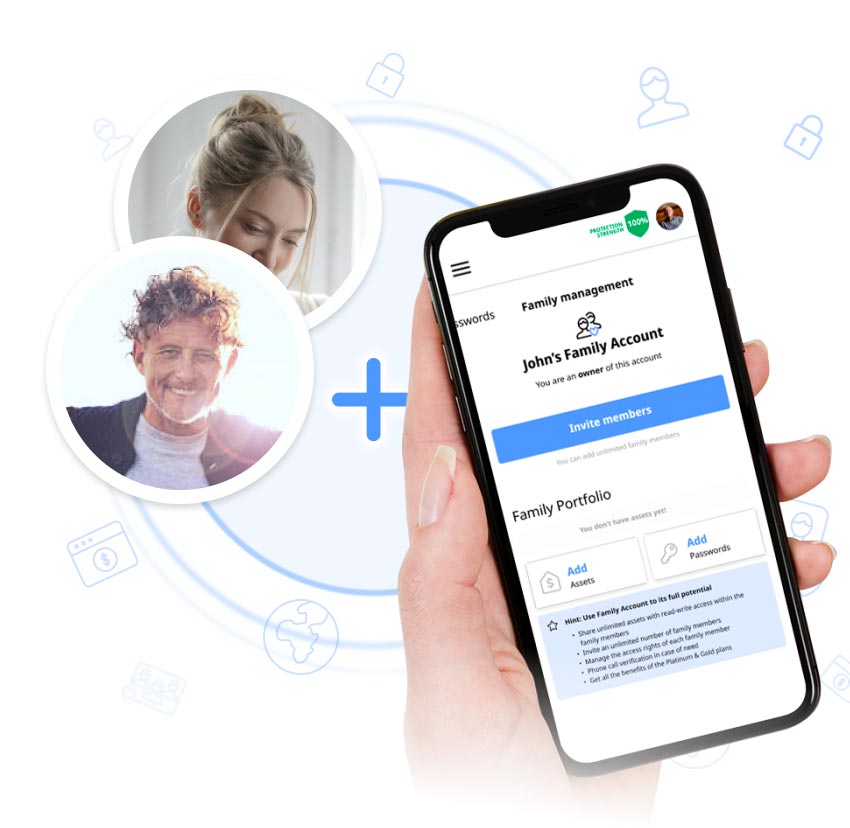

Set multiple owners per asset

Organize, protect, and collaborate

Add an unlimited number of family members

Enter the email addresses of your loved ones to invite them as family members in the DGLegacy® app.

Set individual permissions

As the owner of the Family Account, you have the option to control whether family members can only view or edit information within the Family Account.

Assign multiple owners to a single asset

You can assign multiple owners to each asset in your Family Account, enabling you and your family to collaborate on the protection of your digital assets and passwords.

Organize, protect, and collaborate together

The Platinum plan includes a shared space, the Family Dashboard, allowing you and your closest people to share and organize your digital and financial assets together.

You can view, modify, or upload documents for each of the assets at any time.

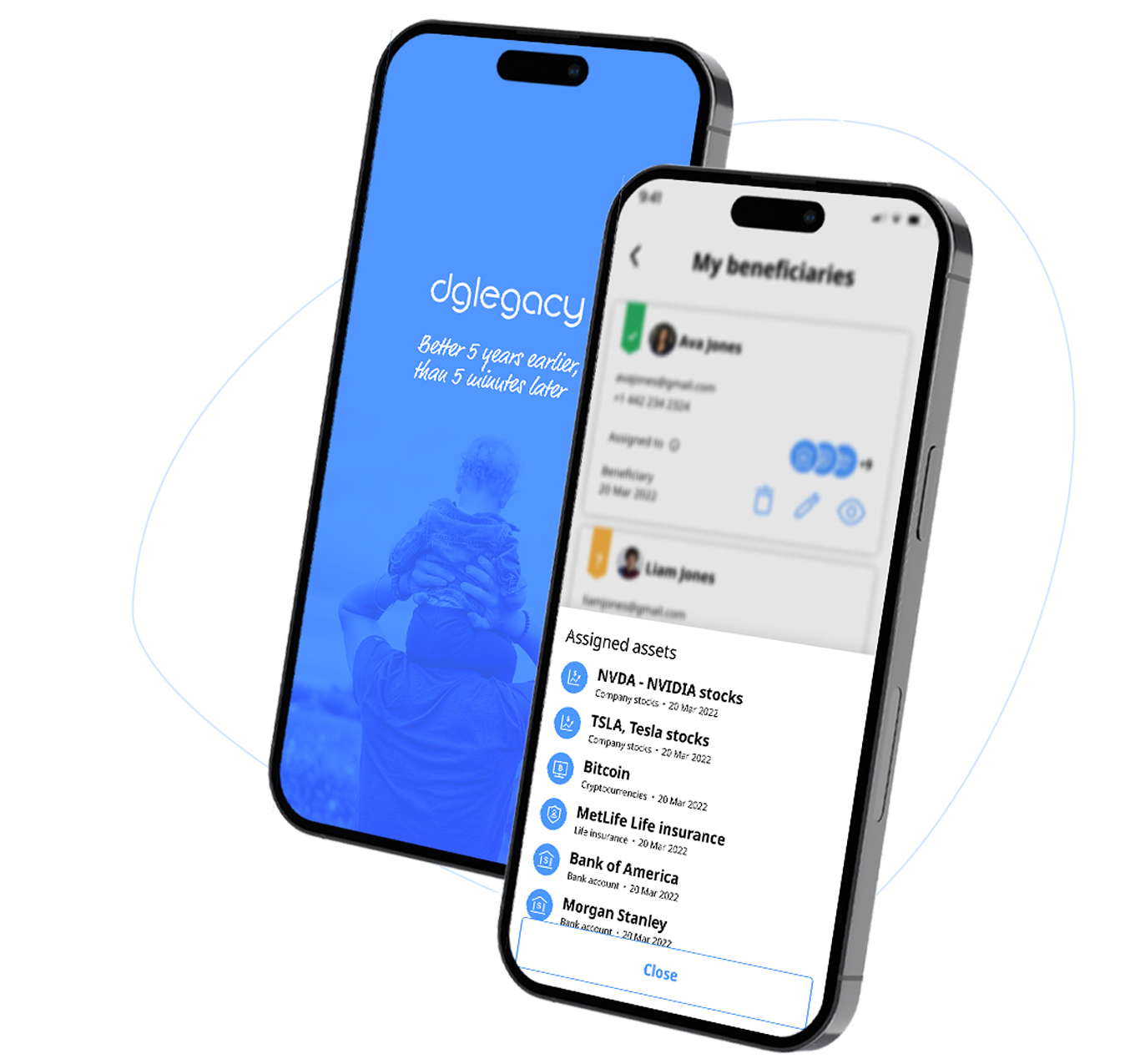

Take Control of Your Digital Legacy!

Protect your loved ones when it matters the most

Register now and start setting up your digital legacy. Be sure that your digital and financial assets are protected.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

Frequently asked questions

What is DGLegacy®?

DGLegacy® is a digital legacy planning and inheritance app through which, in the case of an unforeseen event happening to a user, people whom the user has nominated as beneficiaries will be informed about the user’s assets and will be able to identify and locate them, thus minimizing the chance of an unclaimed asset.

The service offers additional services to protect users' assets and ensure beneficiaries get the support they need in the process of claiming.

Is DGLegacy® a law firm?

No, DGLegacy® is not a law firm. We are not licensed to practice law or to provide any legal advice.

As our ultimate goal is to provide you with the right service to protect your assets and secure your loved ones’ inheritance, our team of experts worked with a renowned law firm to offer additional protection through the legal package “Guide and Inform,” part of the Platinum subscription.

Is the data kept confidential?

Your data is safe with us in highly secure, certified data centers, and we adhere to the highest cybersecurity standards. We comply with top data protection regulations, including CCPA in California and GDPR in Europe.

In which countries does DGLegacy® operate?

DGLegacy® is a global service that can be used in any country.

We are living in a global world where local solutions are no longer apt for solving the global asset protection problem. Often, people are born in one country, live in another, and have physical assets in a third and digital assets around the globe. This new reality requires a global solution, and that’s why we created DGLegacy® as a global service, which you can use anywhere in the world.

We’ve partnered with two of the largest law firms, Cooley LLP and Bird & Bird, to ensure compliance with local legislation.

Have more questions? Let us help. Contact us.

Does my DGLegacy® information have legal authority?

No. The primary purpose of the DGLegacy® service is to ensure that the beneficiaries assigned by users to assets will be informed about these assets in the case of an unforeseen event happening to the user. This will allow them to be aware of the user’s assets and to identify and locate them, thus minimizing the chance of an unclaimed asset.

The claiming of asset ownership is not handled through the DGLegacy® service.

Why is digital legacy planning so important?

Digital legacy planning is essential to ensure that your digital assets are properly managed and transferred to your loved ones or designated beneficiaries after you're no longer around. It helps prevent complications, loss of access, or potential misuse of your digital assets.

I already have an estate plan with a trust and a will. Why do I need DGLegacy®?

Traditional asset protection tools such as trusts and wills have the inherent problem of becoming outdated soon after their creation. The reason is that assets are dynamic. Take a second to think what assets you have now and what assets you had 15 years ago. The two lists are very different, right? Yes, assets change continuously.

As a result, quite often when beneficiaries get access to a trust established by a family member 30 years ago, they are unpleasantly surprised that it’s of no value: the assets listed in the trust documents are no longer valid, while the new assets aren’t listed.

With DGLegacy®, you can complement your existing estate planning by easily keeping a check on your catalog of assets and the designation of beneficiaries who are to be notified in the case of an unforeseen event happening to you.

Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz Victor

Victor