First, let’s make an important distinction: there are, generally speaking, two main types of insurance for bank accounts. There’s the guarantee banks are required or encouraged by the state to provide, and there’s the private type of insurance you can purchase additionally.

The primary differences between them are found in the list of covered events and the amount of money they cover. That is to say, the standard deposit guarantee usually covers a lesser amount and fewer events (normally, the bank going bankrupt). We’ll focus on the first type first – the default guarantee.

What is the ‘default’ deposit guarantee?

Deposit guarantee schemes are widely accepted in many countries and form an integral part of the safety net provided to and by banks. In simple terms, the bank accounts of any person are insured for a given amount should something happen to the bank and it collapses (or files for bankruptcy).

The insurance usually covers just the one event and extends only to personal deposits, not other financial products.

So are all bank accounts in all countries insured?

Nowadays, most (if not all) countries have a deposit insurance authority. This is something that has become widely adopted around the world. Nevertheless, be sure to research whether your country has such an authority or not; just for reference, China didn’t have a deposit guarantee mechanism in place until 2015.

Furthermore, not all banks are obligated to provide such a guarantee, even if there is an authority. It all depends on the country and the regulations in place. Depending on the political and legal systems in a given country, there might even be more than one authority that oversees such operations.

What’s the difference between the deposit guarantee and private insurance?

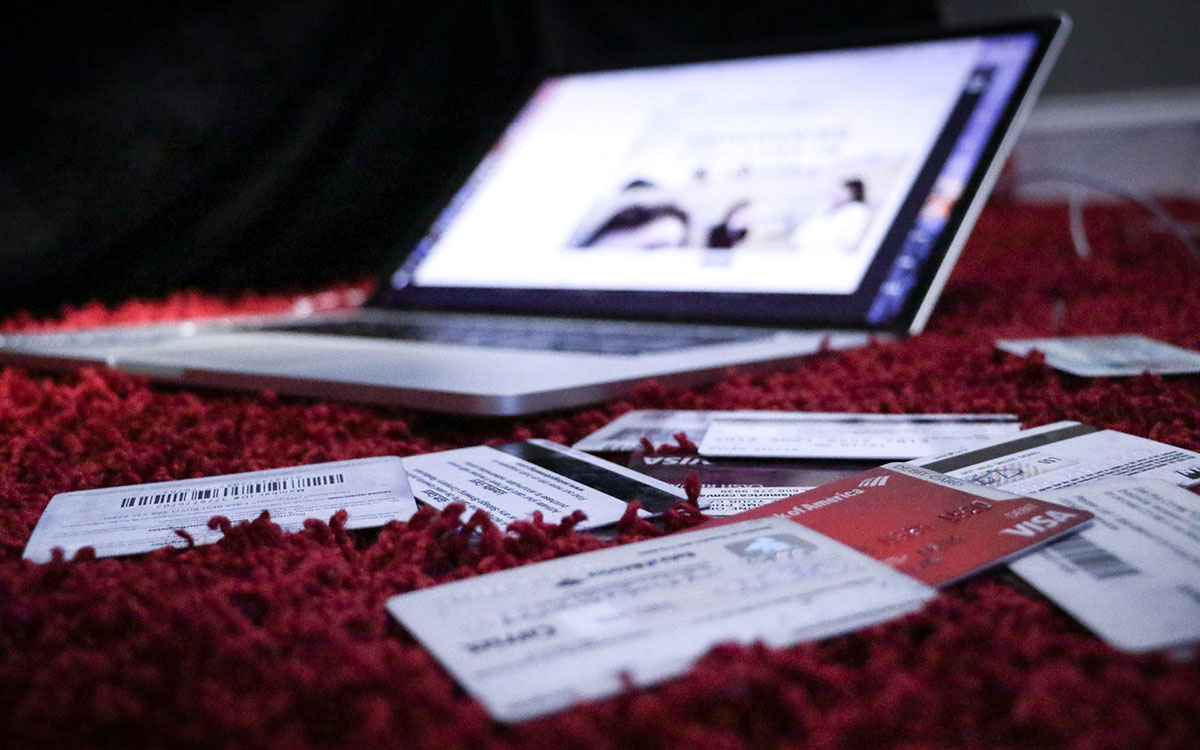

First off, one is a state-operated mechanism (or authority) and the other is a form of private insurance. The deposit guarantee usually covers the bank going bankrupt and a somewhat limited amount of money; it doesn’t cover fraud, theft, or other possible risks.

Private insurance, on the other hand, can cover not only a lot more events, but also a lot more financial products (not only bank accounts but stocks, bonds, etc.) and up to much higher amounts.

Due to those primary factors, private or additional bank account insurance costs money for the insured person. That doesn’t mean the state-operated bank account insurance schemes are free – the costs are put up by the banks (in terms of money reserved for this purpose and not available for the bank’s operations).

It’s safe to say, though, that clients also pay a part of that price with increased banking fees introduced to facilitate this type of bank account insurance.

So what amount does this guarantee usually cover?

As you’ve probably guessed, it depends on the country and the authority – there’s no universal amount up to which your deposit is guaranteed.

For reference:

- US deposits for a single person are generally guaranteed for up to $250 000.

- In Canada, the amount is CAD $100 000.

- The UK authority insures personal deposits for up to £85,000.

- In the EU, it’s €100 000.

There are, however, many factors to consider here that might have an effect on this type of insurance, both in terms of amount and coverage.

Some examples are – whether the account is a sole or a joint one, whether or not there are additional financial products attached to or in use by the bank account, and whether it’s a natural person or a legal entity (though that usually doesn’t make a difference).

Authorities

The administration bodies responsible for overseeing bank account insurance are specific to each country. They have individual policies and rules, both for the participating financial providers and for account holders.

For example:

- In the US, there’s the Federal Deposit Insurance Corporation (FDIC).

- The UK has the Financial Services Compensation Scheme (FSCS).

- The Canadian authority is called the Canada Deposit Insurance Corporation (CDIC).

In conclusion

Though there are many benefits to deposit guarantee schemes, there are certain downsides. Without getting into too many details, some of the biggest disadvantages are related to banks taking on more risk to accommodate their participation in those schemes.

The fundamental inability of those authorities and schemes to accommodate:

- large local shocks (i.e., too many accounts needing to be compensated at the same time);

- the stagnation of resources (i.e., money doesn’t work for its owners but rather sits comfortably in a guaranteed bubble, etc.)

Nevertheless, those types of bank account insurance or guarantee act as a fundamental safety net for a very large number of people, and a needed one at that.

Once a country creates a sustainable and welcoming environment for entrepreneurship and economic growth, those schemes will take the back seat, but until then, they are really needed for the majority of bank account holders.