Life Insurance Beneficiary

Appointing a life insurance beneficiary

Too often, the people who purchase life insurance neglect the topic of beneficiaries. They usually appoint, almost automatically, their spouses, children or other close family members such as parents or siblings. But this incurs many risks, about which most insurance companies, of course, don’t inform their clients.

How will your life insurance beneficiary benefit from the insurance?

Who would know about your life insurance if anything happened to both you and your partner? Would your minor children, who are under the age of 18, be aware of the insurance?

Or when you are in your 60s, will your grown-up children, who have lived in other countries for many years, be aware of it?

The simple question we ask is not how your beneficiaries will step into possession of your life insurance benefit but whether they will do it at all.

Huge amount of life insurance stays unclaimed

You might be unpleasantly surprised to learn that life insurance companies don’t have a legal obligation to proactively notify your beneficiaries!

Insurance companies don’t have a legal obligation to proactively notify your beneficiaries if anything were to happen to you!

Yes, you read that correctly – they will know that something has happened to you, they will know who your beneficiaries are, appointed in the policy by you, but they are not required to notify them! So your spouse or children might never become aware of the policy and receive the proceeds from it.

The blunt truth is that insurance companies simply don’t have any incentive to notify your heirs. It’s way better for them to have the money stay with them.

Let’s see how big the problem is.

How big is the problem?

$1 billion per year in the US alone and only for life insurances. How big is the problem of protecting all types of assets from these risks? As you can see, it’s huge. As of 2020, so-called unclaimed assets approach $100B just in the US. Latest reports for the UK show £77B. Globally, we are talking about trillions of dollars. And the upward trend is alarming: a $5B increase per year in the USA alone.

New York Times

“There Are Billions in Unclaimed Assets Out There. Some Could Be Yours.”

Government agencies have tens of billions of dollars’ worth of bank accounts, insurance…

CNN

“More than 30 million people have unclaimed money or assets. Are you one of them?”

New York (CNN) — You may be among the millions of people nationwide who have cash or assets waiting to be claimed.

Moneyfacts

“Billions lost in forgotten accounts and pensions”

New research from Sanlam UK suggested there could be anywhere between £15bn and £77bn in lost money waiting to be…

Is this problem specific to life insurance?

Did your bank tell you how they would identify and notify your heirs if you abandoned your bank account?

Did the asset management company tell you how they would notify your heirs if anything happened to you? Did they ask you to nominate heirs at all?

The reality is that most asset management tools aim at protecting the value of the assets which they hold but not their ownership.

Traditional asset protection tools such as trusts and insurances focus on protecting the value of the asset but not the ownership.

You would certainly not be happy knowing that your asset had preserved its value but was not in the hands of your family. And as we saw, we are talking of billions of dollars just in the US. Per year!

How does DGLegacy protect your life insurance?

With DGLegacy, you can protect all types of assets. It is also easy to keep your list of assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets

![]() Can identify and locate your assets

Can identify and locate your assets

![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

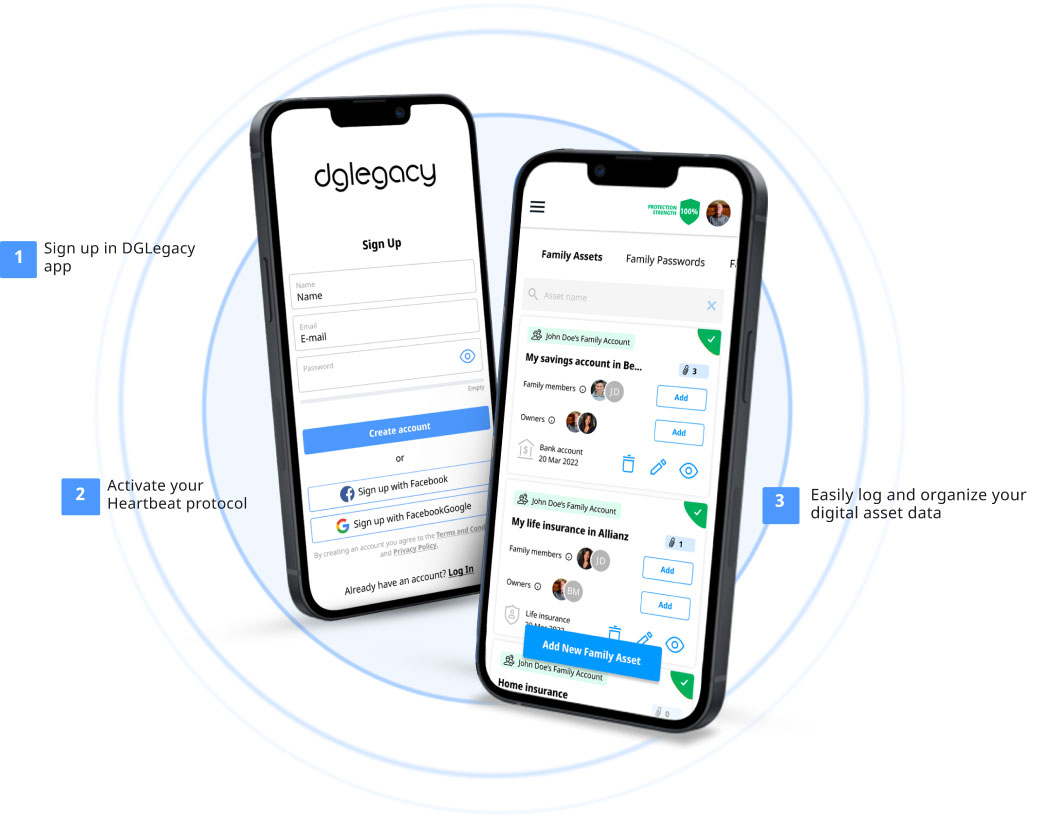

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the people who trust DGLegacy® and start protecting your assets now.

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz