Protect Your Life Insurance

with Digital Inheritance

Unforeseen events happen. Ensure your loved ones receive your life insurance payout.

How big is the problem?

Billions of dollars remain unclaimed instead of reaching the rightful beneficiaries.

New York Times

“There Are Billions in Unclaimed Assets Out There. Some Could Be Yours.”

Government agencies have tens of billions of dollars’ worth of bank accounts, insurance…

CNN

“$58 billion unclaimed: Is some of it yours?”

Unclaimed property comes from a variety of sources, including abandoned bank accounts and stock holdings, unclaimed life…

Moneyfacts

“Billions lost in forgotten accounts and pensions”

New research from Sanlam UK suggested there could be anywhere between £15bn and £77bn in lost money waiting to be…

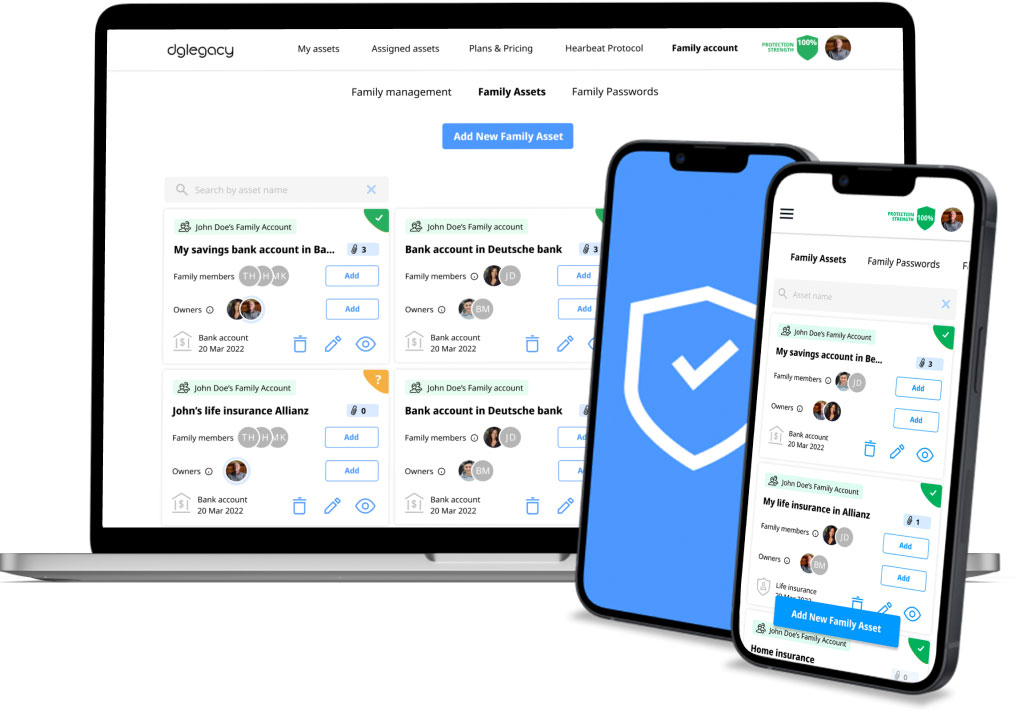

Digital Legacy Planning and Inheritance app

Peace of mind for you and your loved ones.

Protect your assets and ensure they’ll be inherited by your family.

DGLegacy® detects a fatal event, which triggers your digital inheritance.

Proactively informs your beneficiaries about their designated assets.

Ensure your loved ones receive the necessary access information.

So that your loved ones

Are aware of your passwords and digital and financial assets

Can easily identify and locate your assets

Receive the necessary information to access and claim the assets

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

100 000+

DGLegacy® users

600 000+

Protected assets in the platform

5.0

Google review rating

Why DGLegacy?

Digital Inheritance

DIY Experience

Google Sheets, Digital vault, Stored on a personal computer

![]()

Estate Planning

Estate Planning, Trust and Will

![]()

Easily keep dynamically changing asset catalogs up to date

![]()

![]()

![]()

Ability to inform the beneficiaries only in the case of an unforeseen event

![]()

![]()

![]()

Inform the beneficiaries if they forget or lose access

![]()

![]()

![]()

Multi-channel notification of beneficiaries (email, phone)

![]()

![]()

![]()

Support for the beneficiaries in the process of identifying, locating, and claiming assets

![]()

![]()

![]()

Assignment of trustees to the assets to support the beneficiaries

![]()

![]()

![]()

Ability to inform the trustees only in the case of an unforeseen event

![]()

![]()

![]()

Benefits

7/7

1/7

1/7

Digital Inheritance

Easily keep dynamically changing asset catalogs up to date

Ability to inform the beneficiaries only in the case of an unforeseen event

Inform the beneficiaries if they forget or lose access

Multi-channel notification of beneficiaries (email, phone)

Support for the beneficiaries in the process of identifying, locating, and claiming assets

Assignment of trustees to the assets to support the beneficiaries

Ability to inform the trustees only in the case of an unforeseen event

Benefits

7/7

DIY Experience

Google Sheets, Digital vault, Stored on a personal computer

![]()

Easily keep dynamically changing asset catalogs up to date

Benefits

1/7

Estate Planning

Estate Planning, Trust and Will

![]()

Ability to inform the beneficiaries only in the case of an unforeseen event

Benefits

1/7

Find out more about our plans and pricing

Trust, Care and Security

You enter only the minimum high-level information about the assets, which will allow your beneficiaries to identify them.

As a German company data security and confidentiality are our highest priority. DGLegacy do not divulge any data to third parties.

Data protection

Your data is fully encrypted with bank-level security cryptography and used only to operate the service.

Confidentiality & security

We keep the data only in highly secured and certified private data centers in EU. We are compliant with data protection regulations in Europe and USA, like GDPR in EU and CPPA in California.

90 days money-back guarantee!

If you are not satisfied with our service, you can receive full refund at any moment 90 days after your payment. No questions asked.

Norton Trust Seal

SSL/TSL encryption by DigiCert

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the people who trust DGLegacy® and start protecting your assets now.

Sam Tuke about DGLegacy

Sam Tuke

CEO, Lightmeter

Stella Schmitz about DGLegacy

Stella Schmitz

International HR executive

Alara Vural about DGLegacy

Alara Vural

CEO, Alara Vural Coaching

Agnieszka Michalik about DGLegacy

Agnieszka Michalik

Software Architect, HERE Technologies

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

Frequently asked questions

What is DGLegacy®?

DGLegacy® is a digital legacy planning and inheritance app through which, in the case of an unforeseen event happening to a user, people whom the user has nominated as beneficiaries will be informed about the user’s assets and will be able to identify and locate them, thus minimizing the chance of an unclaimed asset.

The service offers additional services to protect users' assets and ensure beneficiaries get the support they need in the process of claiming.

Is DGLegacy® a law firm?

No, DGLegacy® is not a law firm. We are not licensed to practice law or to provide any legal advice.

As our ultimate goal is to provide you with the right service to protect your assets and secure your loved ones’ inheritance, our team of experts worked with a renowned law firm to offer additional protection through the legal package “Guide and Inform,” part of the Platinum subscription.

Is the data kept confidential?

Your data is safe with us in highly secure, certified data centers, and we adhere to the highest cybersecurity standards. We comply with top data protection regulations, including CCPA in California and GDPR in Europe.

In which countries does DGLegacy® operate?

DGLegacy® is a global service that can be used in any country.

We are living in a global world where local solutions are no longer apt for solving the global asset protection problem. Often, people are born in one country, live in another, and have physical assets in a third and digital assets around the globe. This new reality requires a global solution, and that’s why we created DGLegacy® as a global service, which you can use anywhere in the world.

We’ve partnered with two of the largest law firms, Cooley LLP and Bird & Bird, to ensure compliance with local legislation.

Have more questions? Let us help. Contact us.

Does my DGLegacy® information have legal authority?

No. The primary purpose of the DGLegacy® service is to ensure that the beneficiaries assigned by users to assets will be informed about these assets in the case of an unforeseen event happening to the user. This will allow them to be aware of the user’s assets and to identify and locate them, thus minimizing the chance of an unclaimed asset.

The claiming of asset ownership is not handled through the DGLegacy® service.

Why is digital legacy planning so important?

Digital legacy planning is essential to ensure that your digital assets are properly managed and transferred to your loved ones or designated beneficiaries after you're no longer around. It helps prevent complications, loss of access, or potential misuse of your digital assets.

I already have an estate plan with a trust and a will. Why do I need DGLegacy®?

Traditional asset protection tools such as trusts and wills have the inherent problem of becoming outdated soon after their creation. The reason is that assets are dynamic. Take a second to think what assets you have now and what assets you had 15 years ago. The two lists are very different, right? Yes, assets change continuously.

As a result, quite often when beneficiaries get access to a trust established by a family member 30 years ago, they are unpleasantly surprised that it’s of no value: the assets listed in the trust documents are no longer valid, while the new assets aren’t listed.

With DGLegacy®, you can complement your existing estate planning by easily keeping a check on your catalog of assets and the designation of beneficiaries who are to be notified in the case of an unforeseen event happening to you.

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz