Personal Finance

From managing daily expenses to planning for unforeseen circumstances, understanding the ins and outs of personal finance is essential in today’s digital age.

What is Personal Finance?

Personal finance refers to the management of an individual’s or a family’s financial decisions. It involves the process of planning and tracking personal financial activities such as income generation, saving, investing, spending, and protection of assets.

It includes handling of both tangible financial assets such as cash, stocks, and real estate, and digital assets like online bank accounts and cryptocurrency investments.

Effective personal finance management ensures that individuals make wise financial decisions that align with their long-term financial goals.

Why is Personal Finance Important?

Managing personal finance is essential for several reasons:

Security

Proper financial management helps secure a stable financial future and reduces the anxiety related to economic uncertainty.

Wealth Growth

It assists individuals in accumulating wealth over time through effective investment and saving strategies.

Financial Goals

Good personal finance management enables the achievement of financial goals such as buying a home, education funding, or retirement planning.

Preventing Losses

By keeping track of assets, including digital assets, tools like DGLegacy® help prevent losses due to forgotten accounts or unclaimed entitlements.

Personal finance provides a roadmap for financial decisions, helping individuals maximize their earnings, mitigate financial risks, and ensure they can meet both current and future financial obligations and aspirations.

Who is it for?

And in Which Life Situations?

Personal finance is of utmost importance for everyone, from young adults just starting their careers to seniors managing retirement funds.

Life situations where effective personal finance is essential include:

- Starting a new job or career

- Planning for marriage or divorce

- Buying a home or dealing with mortgages

- Saving for children’s education

- Preparing for unexpected medical expenses

- Retirement planning

How Should I Manage My Personal Finance?

Managing personal finance effectively involves several key steps:

- Create a Budget: Understand your income and expenses. Set a budget that allows you to save regularly.

- Save and Invest: Build an emergency fund, save for goals and invest to grow your wealth. Diversify your investment to minimize risks.

- Manage Debt: Keep your debt under control. Avoid high-interest debt and reduce your liabilities as quickly as possible.

- Protect Your Assets: Use insurance and digital asset management tools like DGLegacy to protect your assets and ensure that your beneficiaries can easily locate and claim them if needed.

- Plan for the Future: Regularly review and adjust your financial plans as your personal circumstances and the economic environment change.

Personal Finance When I Am No Longer Around (Legacy Planning)

Legacy planning is critical to ensure that your financial assets are appropriately managed and distributed upon your passing.

It involves:

- Designing a will or estate plan to distribute assets

- Ensuring all financial obligations are clear and accounted for

- Setting up trusts or savings accounts for dependents

- Securing digital assets and making sure they are accessible to loved ones, not forgotten or lost

Key Takeaways

So how do people protect their assets from these personal risks, for example, forgetting about an asset or heirs not being able to locate an asset? Here are the most common protection techniques:

![]() Understand the Basics: Knowing the basics of personal finance is crucial for effective management.

Understand the Basics: Knowing the basics of personal finance is crucial for effective management.![]() Use Digital Tools: Leverage digital tools to enhance your asset tracking and protection.

Use Digital Tools: Leverage digital tools to enhance your asset tracking and protection.![]() Continuous Learning: Stay updated on financial trends and new investment opportunities.

Continuous Learning: Stay updated on financial trends and new investment opportunities.![]() Security and Legacy: Protect your financial and digital assets to secure your legacy and provide for your family’s future even in your absence.

Security and Legacy: Protect your financial and digital assets to secure your legacy and provide for your family’s future even in your absence.

Personal finance is more than just budgeting and saving; it’s about creating a comprehensive approach that incorporates spending, saving, investing, and managing both financial and digital assets effectively.

As digital platforms and tools like DGLegacy® transform how we manage our assets, embracing these changes can lead to more robust financial health and a secure financial future. By understanding personal finance, you can make informed decisions that pave the way for long-term wealth accumulation and financial security.

How Does DGLegacy® Protect Your Personal Finance?

DGLegacy® specializes in securing financial and digital assets through targeted legacy planning and asset protection.

Key features include:

![]() Digital Asset Protection: Helps catalog all your digital assets and secure important digital information.

Digital Asset Protection: Helps catalog all your digital assets and secure important digital information.![]() Asset Identification: Ensures all your assets are properly identified and documented, making it easier for your beneficiaries to be aware and claim them.

Asset Identification: Ensures all your assets are properly identified and documented, making it easier for your beneficiaries to be aware and claim them.![]() Legacy Planning: Provides tools to designate beneficiaries for each asset, ensuring a smooth transition and protection of your legacy.

Legacy Planning: Provides tools to designate beneficiaries for each asset, ensuring a smooth transition and protection of your legacy.

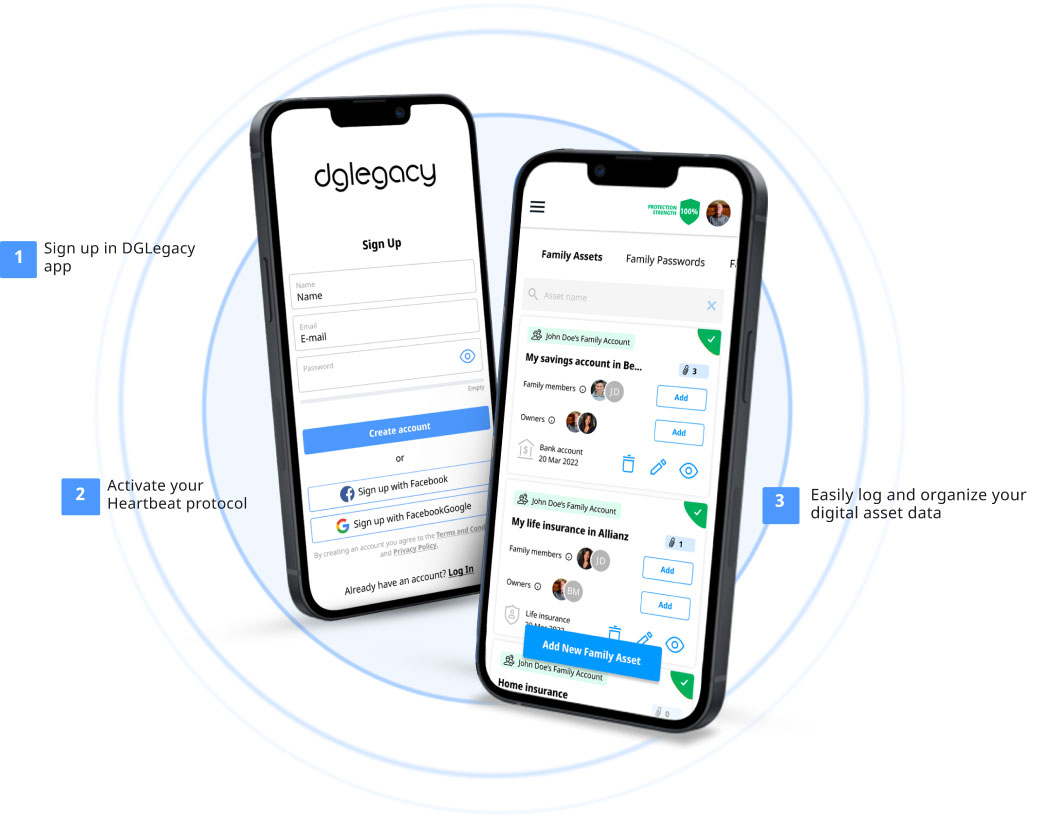

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the people who trust DGLegacy® and start protecting your assets now.

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz